Housing and oil will be two of the sectors that will drive GDP growth in 2022

Colombia closes a multi-edged year with a stretch growing economy, taking into account the main impact caused by the impact of the pandemic.

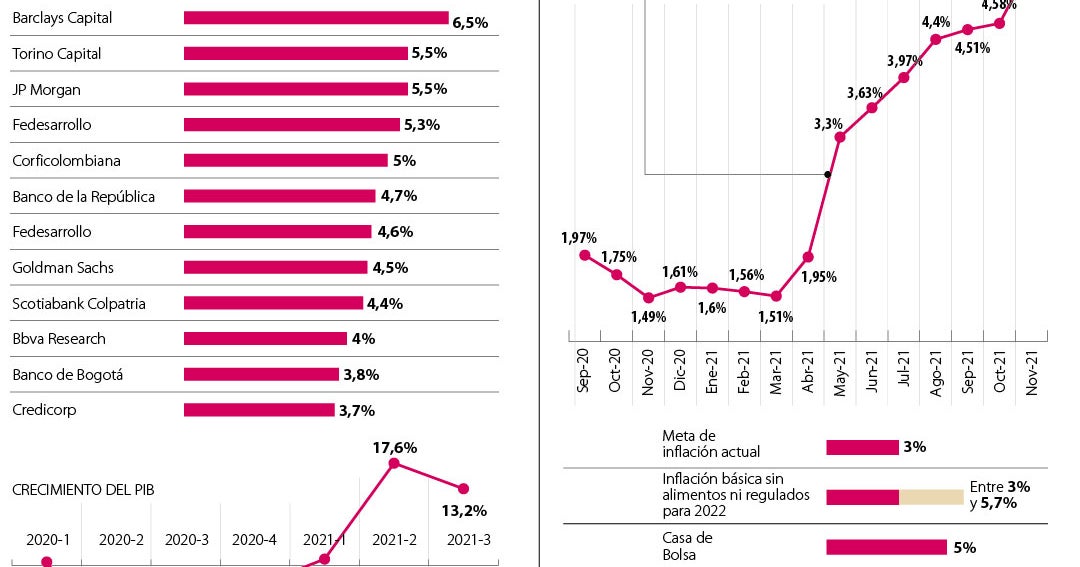

For 2022, although the growth dynamics will not remain the same in the upward revision of 9.7% for 2021, the positive trajectory will become evident with the support of the oil and housing sectors as the main milestones. Thus, according to estimates by the Bank of the Republic, the national GDP next year will grow by 4.7%.

An improvement in external financial conditions, terms of trade, countercyclical fiscal policy, and expansionary monetary policy would help this capacity to recover.

Campetrol President, Nelson Castaneda, confirmed that the vaccination plan against Covid-19 and the emergence and spread of new types of the virus will directly affect the behavior of crude oil prices for the next year. In addition, an adjustment in OPEC production and an accelerated growth of supplies from the United States will be key.

We expect that in the early months of 2022, prices will see downward pressures as a result of reduced demand due to the increase in new cases, particularly in Europe and the United States. Likewise, it is important to emphasize that with the recent decision of the oil union and the restoration of the production rate in the United States, an oversupply can be demonstrated in the first quarter,” Castaneda said.

This is a scenario that does not include new strikes and a new wave of infection.

On the construction side, after ending the best year in home sales in history, with more than 239,000 units sold, Camacol President, Sandra Forero, confirmed that in 2022, 17.7% growth in the country’s GDP is expected. construction sector.

“The figure means 3.5 times more growth than the economy as a whole and production activity will be more dynamic next year,” Forero noted.

As for the total external debt, it represents 56.8% of GDP and 33% in the case of public debt. This was stated by Jacqueline Berragan, Economist at Scotiabank Colpatria, who added that over the next 12 months, the good news in tax collection, derived from good levels of economic activity, may stimulate lower government indebtedness in foreign markets.

However, Ivan Jaramillo, a researcher at the University of Del Rosario’s Labor Observatory, explained that inflation is a concern, which could harm the revitalization process and affect unemployment.

In fact, for 2022, the issuer estimates the CPI at 3.7%, while Corficolombiana and many analysts forecast between 4.2% and 5% at the end of the year.

Externado University economics professor Isidro Hernandez said aggregate demand levels will depend on the unemployment rate, which may approach 10%.

In addition to the health scenario, Francisco Azuero, a professor at the University of Los Andes, has focused specifically on the political level and what is happening in the 2022 elections.

“Award-winning zombie scholar. Music practitioner. Food expert. Troublemaker.”