Magnifying Glass on Extravagance – Rocket to the Moon

In its 2022 tally, the Association of Realtors in the United States reports that the main foreign buyers of homes and condos in Miami were Argentines. according to him a report, 16% of all acquisitions were made by Argentines, in excess of $1 billion. Secondly, they were the most active investors ColombiansWhich amounted to 13% of the total real estate acquired. In third place, in terms of percentages, were Peruvians and Canadians with 8% of real estate transactions executed.

although reconnaissance It does not specify where the buyers are taxed, many of them – of different nationalities – may be eligible to increase their tax contribution, in the event that Joe Biden’s proposals are announced on February 7 in State of the Union cast. During his speech to congressmen, the president announced that he would propose raising the minimum corporate tax rate to 20%, given that in recent years, 55 of the largest corporations in the United States have taken $40 billion in dividends and paid nothing. One dollar tax on this exorbitant income. He also indicated that his administration intends to quadruple the stock repurchase tax, which today stands at barely 1%. Finally, he indicated that companies listed above $1 billion must pay 15%.

All measures promoted by Democrats in the United States are called into question by chambers of commerce of that nationality based in both Latin American and Caribbean countries. Moreover, ambassadors and State Department officials have become the vanguard of the fight against tax justice from the Rio Grande to Tierra del Fuego. This seems to be the principle that governs Washington’s policies towards the region also with regard to antitrust practices: the United States uses them but its diplomatic missions fight them in the rest of the American countries, especially when it comes to transnational companies. capital Cities.

Since 2020, the year the COVID-19 pandemic began, the richest 1% of the world’s population have earned $26 billion, which is 63% of the total wealth generated during that year. 37% of that wealth – about $16,000 million – was distributed to the rest of the world’s population, about 7,000 million people. Half of billionaires have tax residency in countries that do not implement an inheritance tax, a situation that does not usually bother meritocracy advocates.

in the United States, Australia and the United Kingdom, studies The most recent ones show that more than 40% of inflation in these three countries is directly related to the direct increase in corporate profits. In Spain, one of the workers’ centers, Labor committees, that 83.4% of the increases in the prices of basic necessities – during the first quarter of 2022 – were due to corporate greed. Oxfam International report, The richest lawpublished on January 16, 2023, states that the richest 1% have increased their wealth by an average of $2.7 billion per day. Oxfam It also assumes that a generalized wealth tax of 5% – which is only intended to tax the wealth of billionaires – would be equivalent to the necessary amount of part Four of the world’s population overcome poverty. in the past decade, this part of the billionaires accounts for 54% of the global wealth generated. But that percentage has risen to 63% in the past two years.

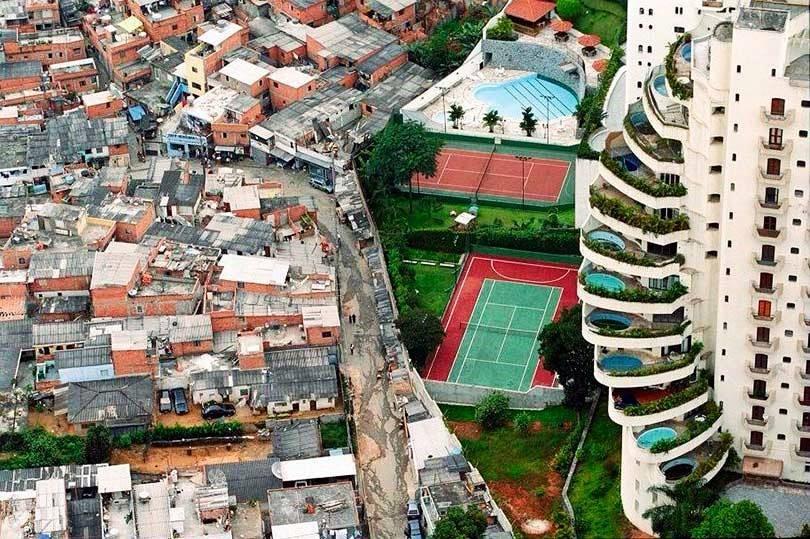

This accumulation at the tip of the pyramid also has its expression in Latin America and the Caribbean. The monopoly of wealth and its flip side, increasing inequality and poverty, have been deepened by the illusion that tax cuts for the wealthy have the potential to benefit the most disadvantaged sectors. Supported by the neoliberal narrative, this practice manages to make it the lowest-income population who contribute the highest relative tax burdens, compared to the billionaires. Elon Musk, one of these billionaires, contributed between 2014 and 2018 a effective tax rate 3% while Aber Christinea flour seller from Uganda, pays 40% of her bills, which is about a thousand dollars a year. Jeff Bezosfounder of Amazon, contributed between 2006 and 2018, 1.1%.

Wealth without work

The rhetoric defending the interests of the most powerful and plunging the most humble into poverty insists on seducing large corporations to establish themselves in some poor or developing country, ensuring competition on ever-lower tax floors. This has led to a general decline in business contributions and an increase in tax burdens on the consumption of goods and services, a practice that has further impoverished the most disadvantaged.

The prevailing paradigm has allowed that most of the income that the rich receive is not directly related to their work, but rather comes from capital income from their assets. In addition, these incomes of capital are taxed – on average – at lower rates than those paid by poor citizens as direct taxes. In the environmental field, the equation is repeated: the richest are those who contribute the most to the spread of the climate crisis. The emissions of billionaires exceed a million times the emissions of the average person living on this planet. The top 1% of humanity is responsible for twice as many emissions as the remaining 50%.

In 2021, the poorest countries will allocate more than 27% of their budgets to servicing their external debt. This amount, in proportion, assumes twice the amount invested by the countries mentioned in education; Four times the contribution they made to fund their health systems, and 12 times their budget for social protection. In addition, middle- and upper-income countries – among them those that make up the Community of Latin American and Caribbean States – are trapped in primary and/or extractive models of production, which tend to concentrate wealth and prevent industrial diversification and the corresponding proliferation of employment. .

In Argentina, a false story of tax pressure has been legalized. Inreport The CEPA setting shows that Argentina shows stresses close to 29%, which is much lower than that observed in countries such as France (46.5%), Spain (36.6%) and Brazil (31.6%). Wealth continues to grow locally, regionally and globally. However, its fruits continue to fall on the same side. The area where workers do not receive benefits.

——————————–

For a $250 per month subscription to Rocket click here

For a $500 per month subscription to Rocket click here

To subscribe to $1,000 per month in Rocket click here

“Award-winning zombie scholar. Music practitioner. Food expert. Troublemaker.”